Direct debit

Funds debited from the nominated account will be sent to nominated superannuation fund/s within five business days, which includes the time it will take for the funds to clear.

Guides

by Beam

|02/07/2024

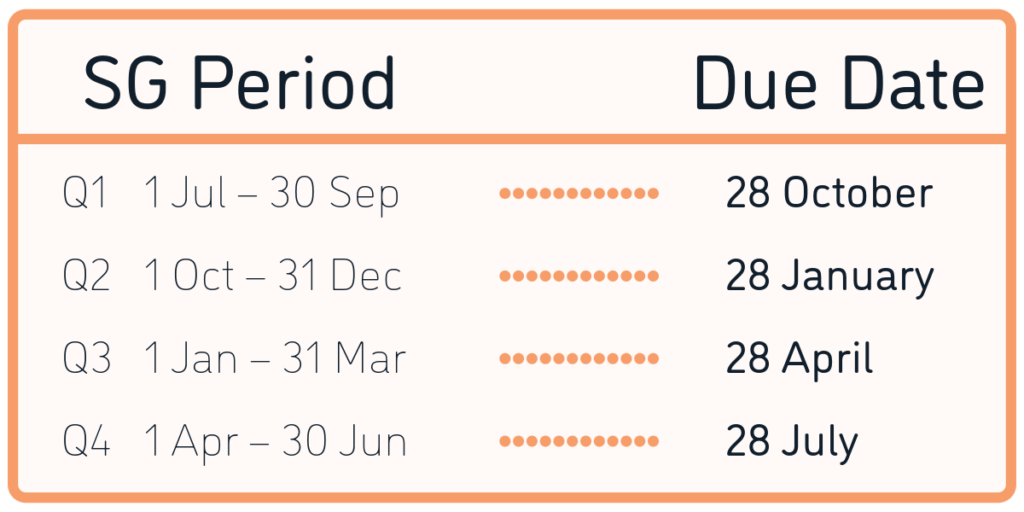

There are a few important dates you’ll need to be across. Firstly, have a look at the SG quarterly due dates for payments to your employees. Employers that are not required to contribute on a monthly basis under an award or industrial agreement can choose to make quarterly contributions.

SG quarterly deadline dates are listed in the table below.

Funds debited from the nominated account will be sent to nominated superannuation fund/s within five business days, which includes the time it will take for the funds to clear.

Funds paid by EFT will be sent to your nominated superannuation fund/s within three business days of us receiving both your contribution details and correct payment.

Funds paid by BPay will be sent to your nominated superannuation fund/s within three business days of us receiving both your contribution details and correct payment

Voluntary after-tax contributions made by your employees need to be sent to the member’s external fund within 28 days of the end of the month in which the deduction from the employee’s salary was made.

Also, processing of payments may be delayed if the member’s external fund doesn’t receive all the information required to process the transaction, or if they don’t receive payment for your contribution. If for any reason, they can’t allocate a contribution to an account, including if they can’t get all the information they need, they will need to return it.

If your organisation fails to pay employee superannuation by the payment due date each quarter, there may be a penalty applicable with the ATO. Please refer to the ATO for specific information relevant to your circumstances.

Back to Knowledge Hub