News

What software providers and their customers need to understand about payday super?

by Beam

|07/06/2024

The federal government’s proposed payday super legislation could cause employers significant time, cost, and compliance issues.

What is payday super?

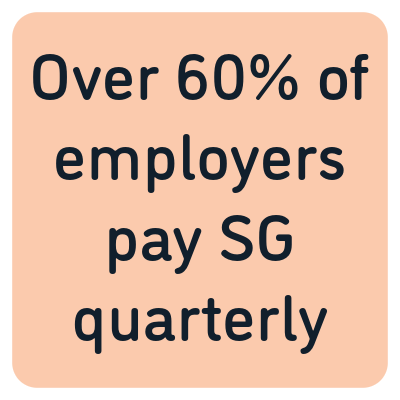

In a move to deliver better retirement outcomes for Australian workers, the government is looking to make sure business owners pay super guarantee (SG) contributions at the same time they pay salary or wages from 1 July 2026, under the proposed payday super reform.

The introduction of payday super supports Treasury data which suggest more frequent super contributions could boost balance at retirement by 1.5%.

Challenges for customers of software providers

Payday super has the potential to compound the shortcomings of small to medium-sized businesses (SMBs) relying on manual payroll processes. In particular, those with high staff turnover and/or contract shift-based workers are likely to struggle to stay on top of new super obligations. And, there are some important challenges to consider.

Greater stapling complexity

Manual file uploads mean the stapling of a super fund to an employee is more labour intensive and time-consuming.

Peter Antonius, CEO at Liston Newton Advisory says employers doing things manually may struggle to act quickly if an employee doesn’t initially select a super fund.

Our greatest challenge will be ensuring processes are efficient and timely so we can make super payments in time for a new staff member’s first pay.

Peter Antonius, CEO at Liston Newton Advisory

Human error and compliance risk

Due to the likelihood of a greater workload, employers battling with manual processes may find themselves more exposed to human error and a heightened risk of not meeting new ATO compliance requirements.

Mathew Gilroy, Founder of Beam and Head of Employer, Platforms and Partnerships at Australian Retirement Trust (ART) expects payday super to increase ten-fold the troubles confronting companies with manual and inefficient payroll processes.

Rising mountain of paperwork

Employers heavily reliant on manual admin and operational processes will likely be staring down the barrel of a lot more admin. Melissa Podruzny, Head of Finance at EngineRoom warns employers paying wages weekly or fortnightly to expect the biggest spike in paperwork.

Podruzny expects this increase in paperwork will make the job of accurately recording, storing and retrieving sensitive employee data increasingly demanding for employers using manual payroll processes to meet potentially weekly deadlines.

Payday super increases admin time and compliance-related pressures and in some cases, businesses may have to increase their super payment frequency to 52 times annually.

Melissa Podruzny, Head of Finance at EngineRoom

Liquidity and cash flow

Podruzny also reminds employers that more frequent SG paymentsmay compound their cash flow challenges.

Given more frequent SG contributions will likely lead to higher processing, transaction and servicing costs, the Institute of Public Accountants (IPA) recently told Accountants Daily that SMBs may collapse under the strain of payday super.

How employers can prepare for payday super

With payday super currently proposed to commence in 2026, good preparation starts now with employers reviewing their current processes and understanding what needs to change to stay ahead of their new obligations.

Here are three practical steps to help get you ready for payday.

Plan for your new super payment frequency.

Review your current onboarding and payroll processes.

Beam helps software providers and their customers

To pay super at the same time as wages, payroll details and super information need to be fully aligned, and this is where Beam’s supertech solution can help.

Beam works with payroll software providers to lighten the workload of Australian employers when paying super to their teams.

By letting employers manage and pay super in one place, Beam delivers a brilliant super payment experience.

Allowing employers to conveniently pay super to employees more frequently as well as track and manage data errors in real-time, Beam’s super payment tech reduces an employer’s admin burden and proves paying employees super doesn’t need to be time-consuming and complicated. Beam has created super payment tech that feels effortlessly intelligent and simply brilliant to

See how your customers can simplify their workflow.

Learn about partnering with Beam Beam has the Supertech for you. Find out more about our other products.Important information

Beam is issued by Precision Administration Services Pty Ltd (Precision) (ABN 47 098 977 667, AFSL No. 246 604). Precision is wholly owned by Australian Retirement Trust Pty Ltd (ABN 88 010 720 840, AFSL No. 228 975) as trustee for Australian Retirement Trust (ABN 60 905 115 063). You should consider the relevant Product Disclosure Statement (PDS) before deciding to acquire or continue to hold any financial product. We are committed to respecting your privacy. For a copy of the PDS, please contact your payroll software provider. For a copy of our Privacy Policy, please phone 1800 572 154 or go to our website.

Back to Knowledge Hub