News

18/10/2024

Payday super: Time is running out … but not with Beam

Ready or not, change is coming. From 1 July 2026 employers will have to pay super at the same time as they pay salary or wages.

Read MoreNews

by Beam

|19/06/2024

Moving from 11% to 11.5% for the new financial year, employers need to ensure they’re contributing the correct amount to their employee’s super funds. This is scheduled by the ATO to continue to rise to 12% by 2025.

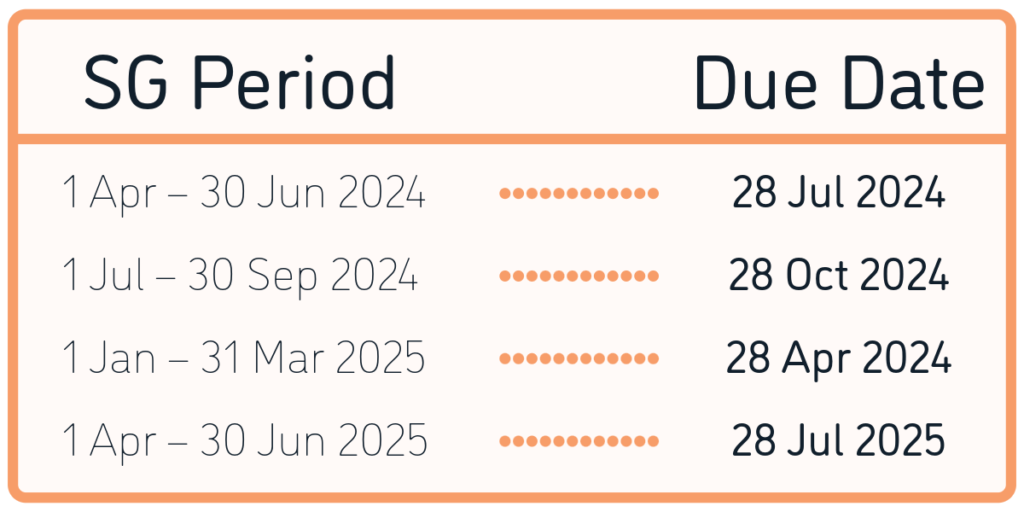

Currently paid quarterly, the next SG period due date is 28 July 2024. This is set to change in 2026 with the addition of Payday Super in this years federal budget.